FHA Mortgage brokers Informed me of the Raleigh Large financial company Kevin Martini

- Thiago Eleocadio

- 18 de novembro de 2024

- payday advances loan

- 0 Comments

In this case, you might be aware on FHA Mortgage brokers plus the prospective advantages of all of them. But what exactly try FHA Lenders as well as how create it really works? Because an experienced large financial company on Raleigh region of so much more than fifteen years, this article has been curated to resolve all of your current questions regarding so it well-known financing system.

In this post, I can express a peek off what you need to know on the FHA money as well as who can apply for that and several of its positives one another economically and you will much time-title. I must say i believe, armed with education towards the FHA Lenders of my personal helpful causes, you’ll generate educated choices that will potentially rescue your thousands of dollars over time that assist you create generational wide range toward proper mortgage strategy.

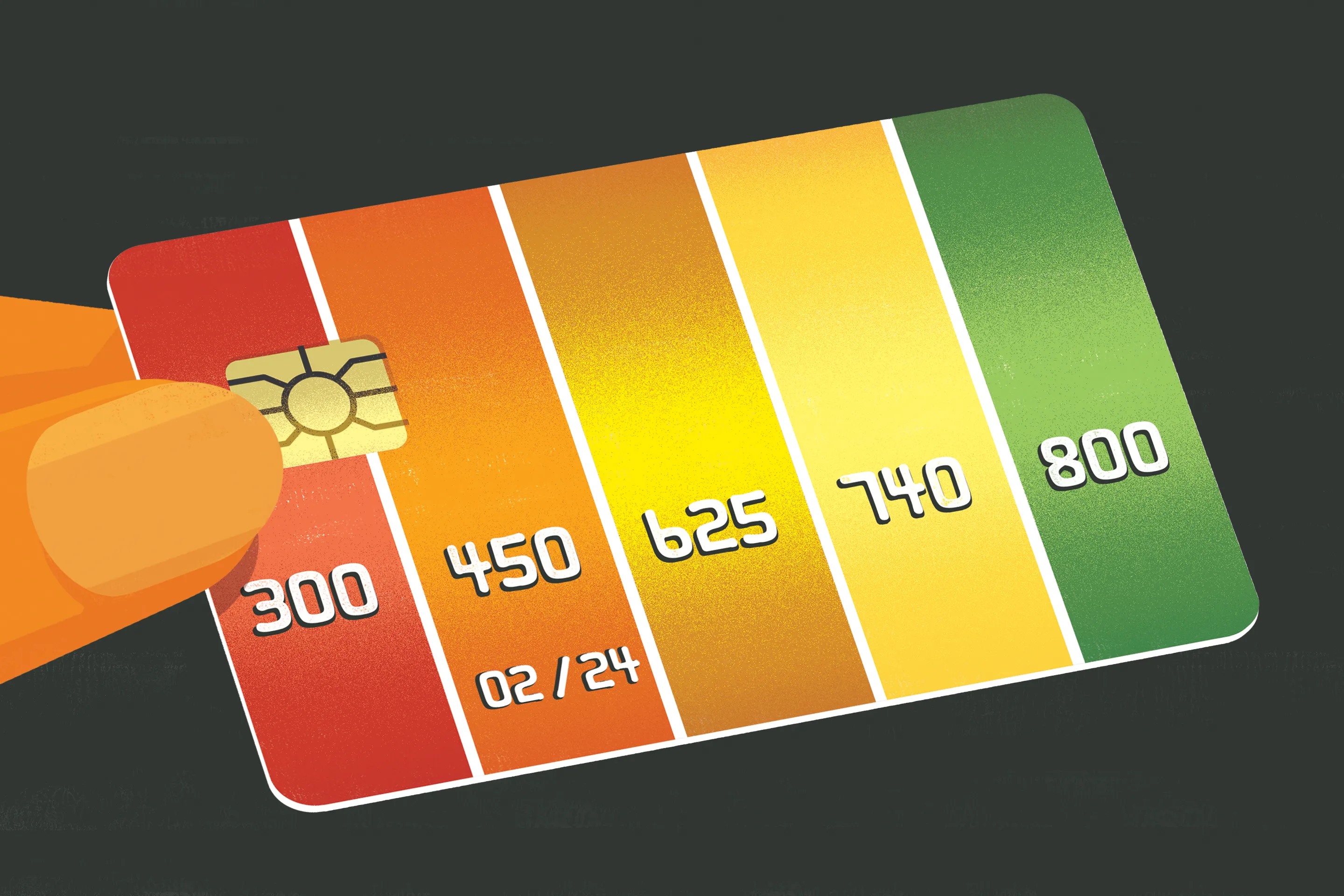

FHA Mortgage brokers is actually a variety of home mortgage that’s covered by the Government Property Government (FHA). It regulators-supported insurance policy is made to help licensed borrowers enter into an excellent house convenient with less money down. FHA financing not one of them a high credit history and offers a lesser advance payment criteria than more traditional mortgages, which makes them an ideal choice to possess earliest-day homeowners and recite homebuyers too!

FHA funds also are incredibly flexible, as possible always buy numerous types of features away from solitary-household members residential property in order to townhomes and much more.

Advantages of FHA Home loan which have Kevin Martini

With regards to masters that come with opting for FHA Lenders, the utmost effective a person is the low-down payment option.

With FHA Home loans, individuals only need to set-out 3.5% of the total cost given that a downpayment. So it matter is significantly below what is normally you’ll need for more conventional mortgages and can end up being hit having a choice out-of financial present such gift ideas of family relations or funds from your neighborhood homes agency.

An additional benefit out of FHA Home loans is because they try assumable, and thus for many who fundamentally want to promote your property, a professional consumer is imagine the bill of the mortgage as opposed to needing to go through the whole recognition procedure once more. This makes it easier for customers and you may suppliers equivalent, especially in the current extremely competitive housing marketplace.

What things to find out about the brand new FHA Home loan

It is important to note, however, one FHA Lenders would feature specific limitations and requirements. The most known ones ‘s the Mortgage Premium (MIP). The FHA Mortgage brokers want borrowers to pay a yearly MIP to keep its loan for the an excellent position. It does add an additional cost on top of the loan alone, but it is crucial that you keep in mind that the newest MIP is really what allows consumers having all the way down fico scores and better debt-to-income percentages to be eligible for that loan in the first place.

Though there isn’t any income restriction that have FHA Lenders, the new borrower need however show an ability to repay the borrowed funds. Thus which have a reliable work and you can proven money is important for acquiring approval.

Concurrently loans in Four Square Mile, the home must be appraised because of the an FHA-At exactly the same time, you will find financing limit set up and therefore may vary according to the specific county and you can/otherwise part of the country. In Aftermath State and you will Raleigh, NC, the mortgage maximum having a-one-friends having a FHA Mortgage for the 2023 is actually $502,550.

As you can tell, you will find some things to consider regarding FHA Mortgage brokers. Myself and entire Martini Financial Classification can help you browse the procedure, so please be connected when you have one inquiries or wants to initiate the application processes. To one another we are able to find a solution which is most effective for you and you will allow you to get into your fantasy family as quickly and simply since you’ll.

The newest Kevin Martini Realization

Now you understand FHA Lenders as well as their potential benefits, it’s time to start your own mortgage travel! When you’re prepared to make step two, get in touch with me now therefore we normally discuss the options and help the thing is that the ideal home loan for your unique problem. Using my leading information and experience with the newest Raleigh home loan sector, I’m confident that you are able to make an educated try most effective for you.

Leave A Comment